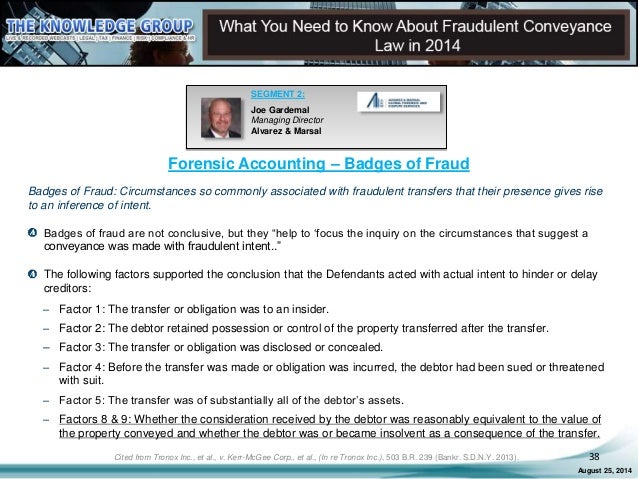

If a debtor receives “grossly inadequate consideration” for the transfer of an asset, or if the debtor cannot pay debts either when they made the transfer or as a result of the transfer itself, the threshold has been met.

In constructive fraud, intent is irrelevant.

Other examples include transferring assets to a relative and setting up shell corporations. For example, a debtor who gives away property in preparation for a bankruptcy filing commits actual fraud.

#FRAUDULENT CONVEYANCE CODE#

The Bankruptcy Code and most state laws recognize two types of fraudulent transfers: actual fraud and constructive fraud.Īctual fraud occurs when a debtor intentionally donates or gets rid of property as part of an asset-protection scheme. The revision and renaming of the UFTA recognized that the act should apply to some transfers that are inconsistent with standard definitions of fraud and pertain to civil (not criminal) remedies. By 2020, 21 states had enacted versions of the revised act, and two more (New Jersey and Massachusetts) have introduced legislation to do so in 2021. This model act, which had been enacted in 43 states, was revised in 2014 and renamed the Uniform Voidable Transactions Act (UVTA). In the United States, both the federal Bankruptcy Code and state laws address fraudulent transfers.Īt the state level, the common law of fraudulent conveyance was first codified by the Uniform Fraudulent Conveyance Act of 1918, which was replaced by the Uniform Fraudulent Transfer Act (UFTA) in 1984. Modern fraudulent transfer laws trace their roots back to Elizabethan England and “the Statute of 13 Elizabeth” passed by the English Parliament in 1571. Individual states may adopt a model act with specific changes, thus giving it the force of law. In most states, the primary tools for addressing debtors’ transfers are adopted versions of a “model act” known as the Uniform Fraudulent Transfer Act (UFTA) or its new version, the Uniform Voidable Transactions Act (UVTA). Section 550 deals with the transferee’s defenses, with some language that speaks to the limitations of fraudulent transfer actions in bankruptcies. Section 548 of the United States Bankruptcy Code establishes the fundamental law of fraudulent transfers in bankruptcy.

A common complication of debtor/creditor relations in bankruptcy, a fraudulent conveyance or fraudulent transfer is an attempt to prevent creditors from reaching a debtor’s assets by transferring them to a third party. “Fraudulent conveyance” is a centuries-old term that has been in the news recently because of its prominence in high-profile bankruptcy cases.

State laws dealing with asset transfers concerning bankruptcy are getting a closer look because of a new version of the Uniform Fraudulent Transfer Act

0 kommentar(er)

0 kommentar(er)